Affected by sales of heavy trucks Weifu Hi-Tech cuts its target

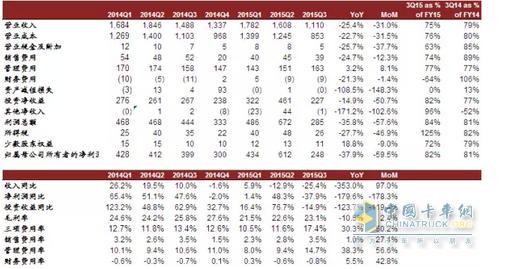

CICC Motors downgraded Weifu Hi-Tech from recommendation to neutrality because the decline in sales volume in the heavy-duty truck industry and the increase in the penetration rate of relevant products in the company's country 4 have basically ended, making the company's share price under pressure in both performance and valuation. Revise down the target price of Weifu Hi-tech A/B shares by 25%/25% to HK$24/HK$24, downgrade to Neutral. reason The business of the Division was affected by the decline in the heavy truck industry. Weifu Hi-Tech 3Q15 (Q3 2015) revenue of 1.15 billion yuan, down 25.4% year-on-year, and 31.0% MoM, while 3Q15 heavy truck sales were 113,000, down 26.0% YoY and 29.5% MoM, indicating that the company The operating revenue is basically synchronized with the sales growth of the industry. In terms of investment income, United Electronics continued to maintain growth, and Bosch Automobile and Diesel Corp. declined year-on-year. The company's 3Q15 investment income was 230 million yuan, down 14.9% year-on-year and down 50.7% from the previous quarter. We believe that the decline in investment income is mainly due to Bosch Diesel. Since the first half of this year in the country's 4 full promotion period, manufacturers have actively stocked, Bosch Automotive Diesel in the 3Q15 facing the decline in the industry sales and customer inventory to the double challenge. Existing businesses have become cash cows, looking for new growth points. Looking back at the company's growth in the past five years, after China’s heavy truck sales reached a historical high of 1.01 million units in 2010, the company’s net profit declined in 2011 and 2012 as sales of heavy-duty trucks declined for the second consecutive year. From 2013 to 2014, the company’s net profit declined. Emissions from diesel engine 4 were upgraded, and the company's net profit increased significantly by 2 years. Looking ahead, it is expected that China 4 will have a certain role in driving the growth of the company's performance, which will be mainly embodied in Weifu Lida, followed by Bosch Diesel Engine and Weifu Automobile Diesel. However, related businesses have gradually become a single-digit cash cow business, and the company urgently needs to find new performance growth points. Profit forecast and valuation The company lowered the profit from its parent company in 2015 and 2016 by 13% to RMB 15.81 million and RMB 17.64 million, and lowered the company's 2015 and 2016 earnings per share by 12% to 1.57 yuan and 1.75 yuan. Under the background of the slowdown in the company's performance growth, CICC Motors believes that the company's share price is facing downward pressure on performance and downward pressure on valuation. We downgrade the A/B shares rating of the company to “Neutralâ€, and cut the target price of Weifu Hi-Tech and Suweifu B by 25% to 24 yuan and 24 Hong Kong dollars, respectively, corresponding to 15 times P/E and 12 times P/E in 2015. risk A new round of economic stimulus policies has successfully boosted demand for heavy trucks. Weifu High-Tech Quarterly Financial Data Earnings forecast adjustment Digital Display Hydraulic Universal Testing Machine Pollution Testing Machine,Digital Display Pollution Testing Machine,Iron-Tower Testing Machine,Digital Display Testing Machine Jinan Chenda Testing Machine Manufacturing Co., Ltd. , https://www.jncdtester.com